P2P Lending, Business Lending, Crowdlending: Easy Loans For Personal?

Various providers in Switzerland grant loans to companies and private individuals. Who the individual decides for when taking out a loan varies from person to person and depends on several factors.

Personal loans as a simple solution

If you need a loan in Switzerland, you go to a bank with your request and submit the corresponding application there. Personal loans can also be applied for digitally or via an online provider, with a classic lender behind the loan or a crowdlending platform that is not dependent on a specific bank.

No borrower has to specify a purpose here, so it does not matter whether the loan is used to buy a car, a new kitchen or for the planned vacation.

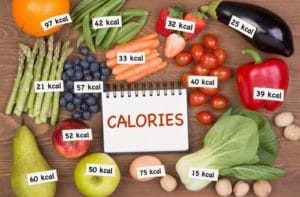

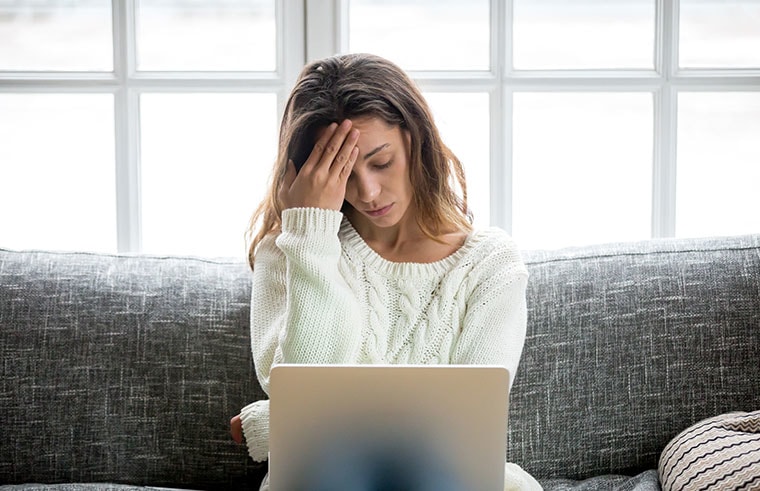

Whether the requested loan is granted at all depends on how the applicant's creditworthiness is rated. How big is the chance that he will actually pay back the borrowed money in the given time? The banks use a kind of catalog of criteria for this and obtain information from a credit agency.

The Central Office for Credit Information is well informed about people's creditworthiness! After this assessment, the personal loan can be determined in terms of amount and term as well as the conditions. In this respect, the creditworthiness not only influences whether the applicant gets a loan at all, but also how good his conditions and especially the interest rates are.

Crowdlending as an alternative

In Switzerland there are now several different platforms on which crowdlending loans are possible. This form of credit is also known as P2P credit and describes the internet-based granting of loans.

Put simply: There is a larger group of private individuals who invest an amount X. This is put together and given to a person as a loan. Such loans also go to companies, although the sums can be very low. The crowdlending platforms are the intermediaries where the two partners involved come together. Loan seekers present their projects and give the lenders the opportunity to assess the project as lucrative or as a potential loss-making business.

If the lender decides to invest his money in a project, he will receive interest on the repayment. Important: Here, too, collateral is required and the loans must of course be repaid in full and with interest. The advantages of crowdlending are obvious:

-

- simple online application possible

- also possible with bad credit ratings

- quick decision on the loan application

- different loan amounts possible

However, crowdlending also has disadvantages such as absurdly high interest rates, a high rejection rate for apparently unprofitable projects and often a lack of transparency in fees.

Nevertheless: For many people in Switzerland, P2P loans have become a good way of raising money for certain projects in recent years.

Even if banks classify these projects as not very promising and do not want to grant a loan, crowdlending may still find lenders who are interested in further developing the idea in question. It is not for nothing that the crowdlending sector recorded very high growth from 2018 to 2019!

Conclusion: Different types of credit for different target groups

In addition to the classic personal loan from the bank, which can also be applied for online, crowdlending is now an interesting alternative in Switzerland. The loan seekers are given the opportunity to present themselves and their project and to look for investors. These decide on the amount of their participation in a project and are given a return accordingly.

If it turns out that the borrower is not solvent, the previously requested collateral can be attached. Crowdlending is sometimes considered to be riskier, but there are also loans available here that would not be possible with a bank. The latter first sees the creditworthiness of the applicant and only then pays attention to the possible lucrative value of the project in question, with crowdlending it is often the other way round.

divide

Credit comparison Switzerland

Calculate credit and compare all providers